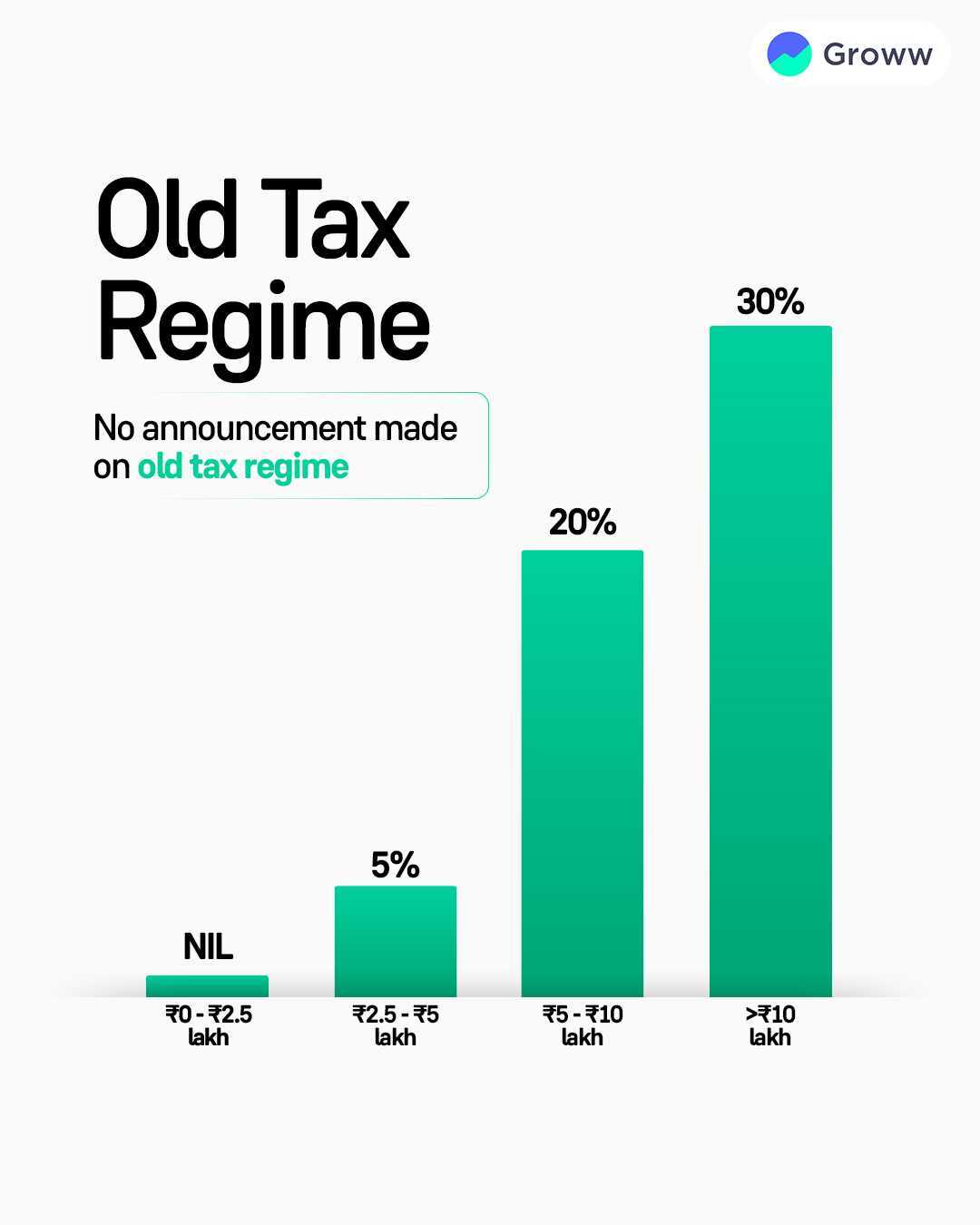

The old tax regime in India has been the traditional tax structure under which individuals and businesses have been taxed for years. With the introduction of the new tax regime in 2020, taxpayers now have the option to choose between the old and new systems, each offering distinct benefits and trade-offs.

- Advantages of the Old Tax Regime

- Tax Savings Through Deductions: Individuals who have significant investments in tax-saving instruments can benefit from lower taxable income.

- Encourages Long-Term Investments: The availability of deductions incentivizes long-term financial planning and investment in retirement funds, insurance, and savings schemes.

- Housing and Education Benefits: Home loan interest and education loan benefits help taxpayers manage long-term financial commitments efficiently.

- Choosing Between Old and New Tax Regimes

- The choice between the old and new tax regimes depends on an individual’s financial situation. The old tax regime is ideal for those who invest significantly in tax-saving instruments and can maximize deductions, while the new tax regime offers simplicity and lower tax rates without deductions.

- Conclusion

- The old tax regime remains a viable option for taxpayers who prefer traditional tax-saving mechanisms and long-term investment benefits. However, with the new tax regime providing an alternative with lower tax rates, taxpayers must carefully analyze their income, investments, and financial goals before making a decision.